year end accounts deadline

Its estimated that the average accounting team takes 25 days to complete an annual close. A digital company tax return CT600 must be filed with HMRC annually.

Solo 401k Contribution Limits And Types

For example companies with a 31st December 2020 year end will have to file their accounts by 30th September 2021.

. The time allowed for delivering accounts is 9. If you want to file a paper copy of CT600 you must have a. Also called the accounting reference date the period at the end of which the financial records of your company are closed and the statutory accounts are filed with HMRC and Companies House.

All three journal entries are posted to record either revenue or expenses in December before the fiscal year-end closing. Apply to extend your accounts filing deadline Use this service to apply for more time to file your annual accounts with Companies House. The company is in.

9 months after your companys financial year ends. Deadline to submit all 2020 activity. To a maximum of 18 months or longer if your companys in administration.

Accounts Payable AP including Non-employee reimbursements Initial AP Cut-off. 21 months after the date you registered with Companies House. You can check this on the Companies House website here.

The deadline for your tax return is 12 months after the end of accounting period it covers. Pay corporation tax to HMRC or tell them that the company doesnt owe any 9 months and 1 day after the end of your accounting. Last day to request changes to information reflected in the Year-End 2021 Financial Reports.

30 April 2019 - nine months after the year end. The demand for the audit of the accounts should be in the form of a notice to the company deposited at the registered office at least one month before the. File annual accounts with Companies House.

You should look to prepare sole traders accounts and partnership accounts well ahead of the tax return deadline of 31st January. Deadline to review 2021 activity. Friday February 25 2022.

Anything received after January 22 2020 will be recorded as 2021 activity. For existing companies it will be the anniversary of the day after the previous financial year ended. What are end of year accounts.

January 22 2021 Friday. Data available to Tubs on Friday morning 624 in HDW. 28 February 2019 - nine months after the year end.

31 March 2019 - nine months after the year end. File your Company Tax Return with HMRC. There are penalties for late filing.

Week of March 1-4 2022. Thursday 616 at 500 pm. Thursday 616 will be posted to the GL by COB Thursday 623.

Year end is the end of your companys accounting period. Last day to request changes to information reflected in the Year-End 2021 Financial Reports. Your records must be kept for six years from the end of the last financial year they pertain to.

Closing Deadlines and Submission Information. Company Year End Accounts Filing Deadline The best way to avoid these it to be aware of your responsibilities and keep good records from the start. Accrual accounting entries are not recorded in the accounting records based on cash inflows or outflows.

If no requests for changes have been received Division Accounting will proceed to close the year and generate final draft reports for your records. File subsequent annual accounts with Companies House 9 months after the end of your companys financial year. The deadline for completing accounts year-end is usually 12 months after your companys financial year-end.

To file annual accounts with Companies House. Each year finance professionals bury their heads in the books to prepare their end-of-year accounts statements and financial reporting. File first accounts with Companies House.

For most businesses this will be the same as their calendar year. Please ensure all 2020 revenues andor expenses is submitted by this day. 31 January 2019 - nine months after year end.

FY22 invoices submitted by 500 pm. Once every 5 years. So if your companys financial year-end is 30th June you would need to complete your accounts by 30th June of the following year.

You can only lengthen the financial year more often than every 5 years if. Mail by January 15. It will normally include information such as.

Companies House Deadlines for filing the accounts with the accounting year ended. The remaining 5000 balance in prepaid insurance is expensed in the next fiscal year. Already extended your accounts deadline.

Companies typically have nine months from their year end to complete their accounts but its always best to check on Companies Houses website what the company accounts filing deadline is.

Year End Accounting For Limited Companies Made Simple

Business Tax Deadline In 2022 For Small Businesses

Us Tax Filling Deadlines And Important Dates Us Tax Law Services

When And How To File Your Annual Accounts With Companies House Companies House

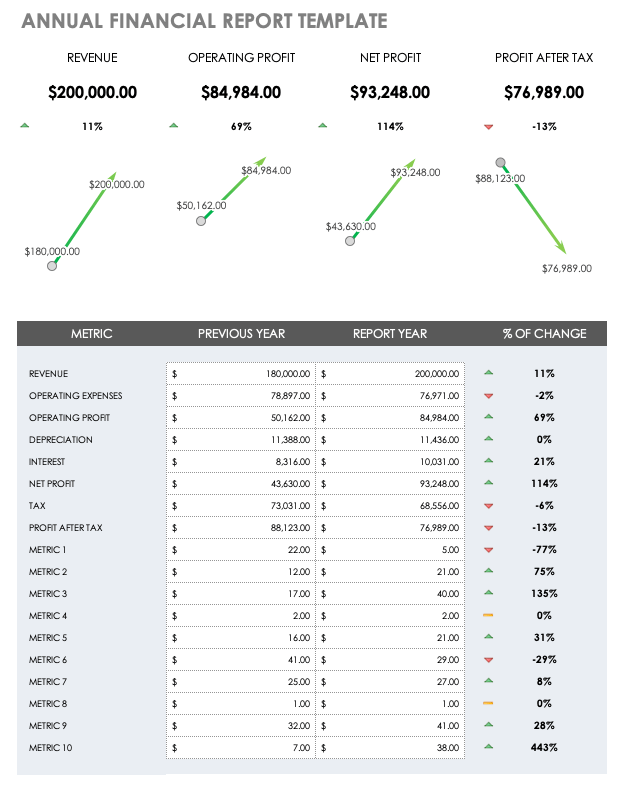

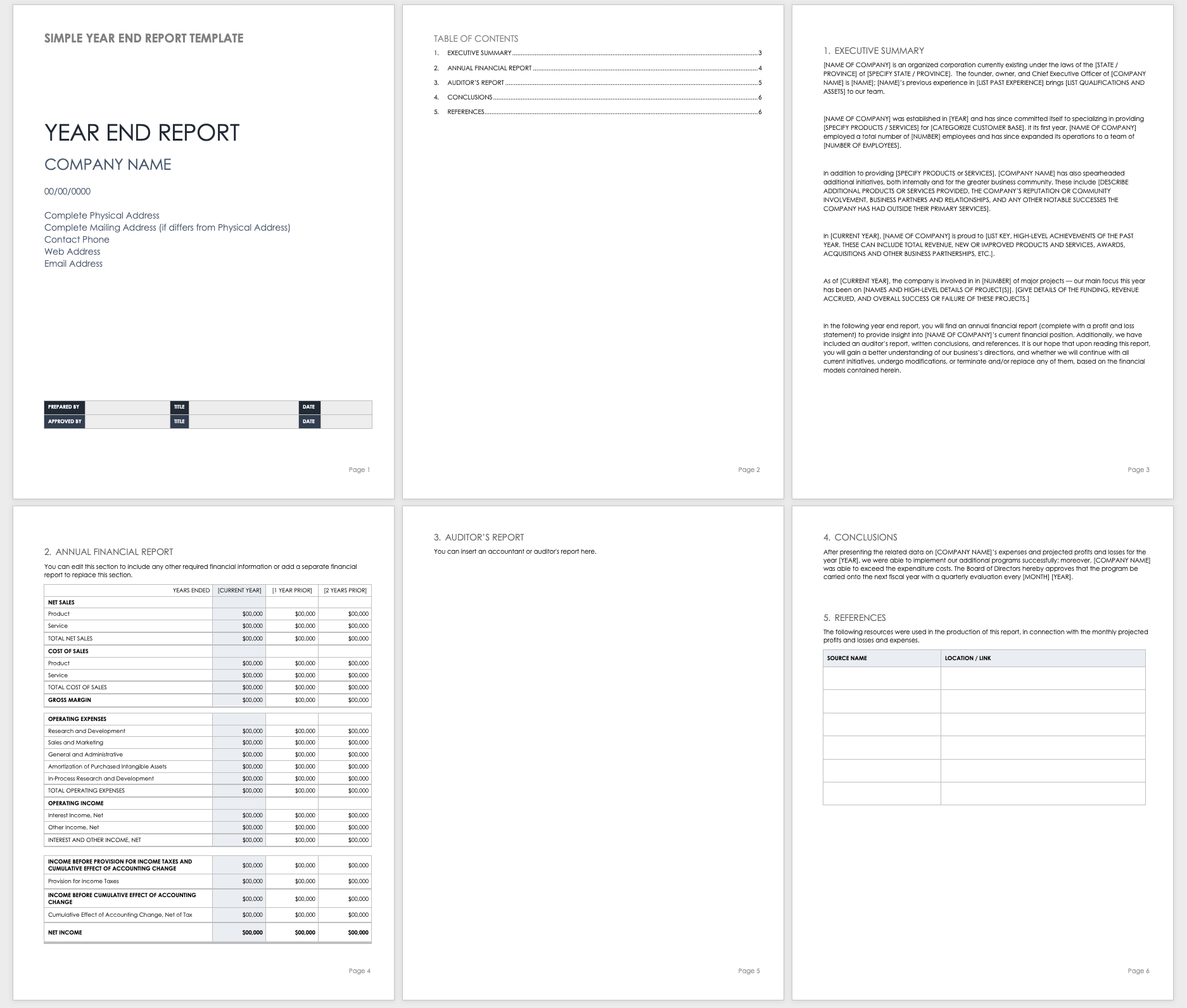

Free Year End Report Templates Smartsheet

Solo 401k Contribution Limits And Types

Free Year End Report Templates Smartsheet

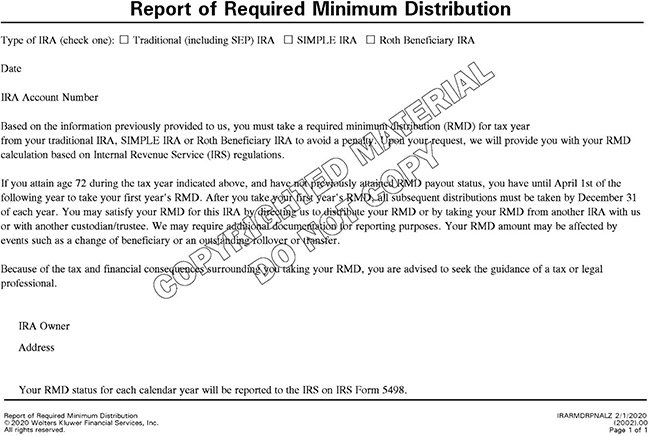

Individual Retirement Accounts Rmd Notice Deadline Approaching Wolters Kluwer

Annual Accounts Italian Business Register

Individual Retirement Accounts Rmd Notice Deadline Approaching Wolters Kluwer

Ira Contribution Deadlines And Thresholds For 2022 And 2023 Smartasset

Individual Retirement Accounts 2021 Contribution Reporting On Irs Form 5498 Wolters Kluwer

Year End Accounting Checklist How To Close The Fiscal Year

:max_bytes(150000):strip_icc()/ScreenShot2021-09-18at11.07.48AM-240bfff397eb407f9736d065e74f55ec.png)

/ScreenShot2021-09-18at11.10.03AM-241ecfcb218d46bdbb4b16a285992b69.png)

/ScreenShot2021-09-18at11.10.03AM-241ecfcb218d46bdbb4b16a285992b69.png)